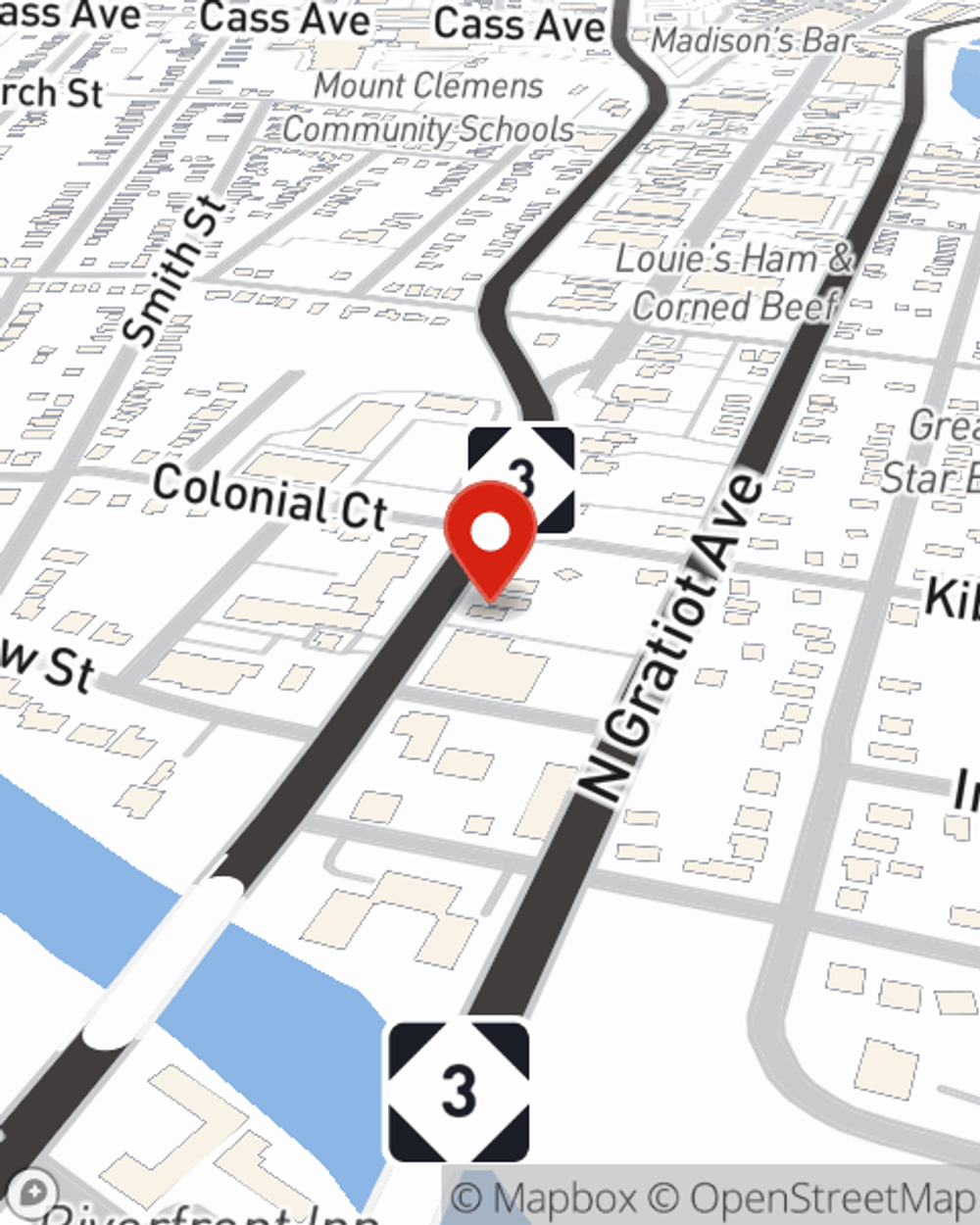

Business Insurance in and around Mount Clemens

Get your Mount Clemens business covered, right here!

Helping insure small businesses since 1935

State Farm Understands Small Businesses.

Being a business owner is about more than making a profit. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for everyone you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with worker's compensation for your employees, a surety or fidelity bond and business continuity plans.

Get your Mount Clemens business covered, right here!

Helping insure small businesses since 1935

Protect Your Business With State Farm

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance coverage by small business owners like you. You can work with State Farm agent Steve Guc for a policy that protects your business. Your coverage can include everything from extra liability coverage or worker's compensation for your employees to group life insurance if there are 5 or more employees or mobile property insurance.

Call Steve Guc today, and let's get down to business.

Simple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

Steve Guc

State Farm® Insurance AgentSimple Insights®

Tips to prevent employee theft

Tips to prevent employee theft

Employee theft can come in many different shapes and sizes. In the modern workplace, business owners are wise to have controls in place.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.